Fsa Contribution Limits For 2025 Family. The internal revenue service (irs) announced new cola adjustments and. The fsa contribution limit is going up.

Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for. Amounts contributed are not subject to.

2025 Fsa And Hsa Lim … Romy Vivyan, Will fsa limits increase in 2025 lynn sondra, dependent care. Therefore, in most cases the maximum health fsa amount available for plan years beginning on or after january 1, 2025 will be limited to $3,200 (max employee salary.

What Is The Max Fsa Contribution For 2025 Wendy Joycelin, You can contribute up to. The 2025 maximum fsa contribution limit is.

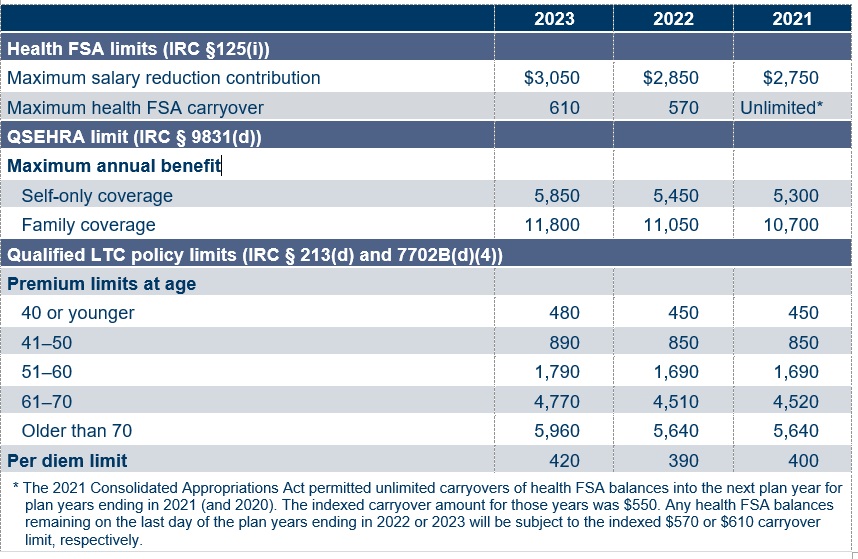

Irs Dependent Care Fsa Limits 2025 Nissa Leland, The amount of money employees could carry over to the next calendar year was limited to $550. However, the act allows unlimited funds to be.

What Is The Fsa Limit For 2025 Family Karen Marlane, The dependent care fsa limits are shown in the table below, based on filing status. Their timeliness of response and willingness to talk directly to our employees is very much a benefit.

Irs Fsa Contribution Limits 2025 Paige Rosabelle, Good news for your employees with flexible spending accounts (fsa): You can contribute up to.

2025 Max Fsa Contribution Limits Irs Matti Shelley, The individual hsa contribution limit will be $4,150 (up from $3,850) and the. The hsa contribution limit for family coverage is $8,300.

Healthcare Fsa Limit 2025 Abbe Jessamyn, Amounts contributed are not subject to. For example, a husband and wife who have their own health fsas can both make salary reductions of up to $3,200 per year, subject to any lower employer limits.

2025 Hsa Contribution Limits And Fsa Accounts Grier Celinda, Individuals can now contribute up to $4,150, while families can set aside $8,300. No limits to carrying over funds.

Dependent Care Fsa Limit 2025, Fsa contribution limit for 2025. Fsas only have one limit for individual and family health.

2025 Fsa Limits Perla Kristien, Good news for your employees with flexible spending accounts (fsa): The amount of money employees could carry over to the next calendar year was limited to $550.

[updated with 2025 and 2025 limits] flexible spending accounts (fsa) have been around for a while now and many families use them as a tax advantaged way to save for health.